Buying a home can be a thrilling adventure, but it can also be a minefield of paperwork, negotiations, and local quirks. That’s where a local real estate agent comes in – your trusty guide to navigating the housing market. Let’s explore why hiring a local agent is a smart move:

1. Local Knowledge, Local Love 💚

A local agent knows the area inside and out. They’re familiar with the best neighborhoods, schools, and hidden gems. They can tell you about the local coffee shops, the best hiking trails, and the annual town festivals. This insider knowledge can help you find a home that truly fits your lifestyle and Front Porch Realty has you covered on all things Local & Fuquay-Varina!

2. Spotting Hidden Potential 🔎

A seasoned local agent has a keen eye for a home’s potential. They can see beyond peeling paint and outdated fixtures. They might recognize a diamond in the rough – a fixer-upper with great bones and endless possibilities. Front Porch Realty agents take the time to listen and understand your main goals when it comes to searching for the perfect home. Whether you have accessibility needs, more rooms, a fenced-in back yard, or a better commute to your work, our agents will always keep your interests first.

3. The Art of Negotiation 🤝

Negotiating a home purchase can be a delicate dance. A skilled local agent knows how to negotiate effectively, without compromising your interests. They’ll leverage their knowledge of the market to get you the best possible deal.

4. Navigating the Paperwork Jungle 📃

Buying a home involves a mountain of paperwork. From loan applications to closing documents, it can be overwhelming. A local agent can guide you through the process, ensuring everything is in order and on time.

5. Local Connections, Local Perks 👍

A local agent often has connections with other professionals in the area, such as mortgage brokers, inspectors, and contractors. These connections can save you time and money, especially when dealing with local regulations and permits.

6. Understanding Fuquay Market Trends 📈

The housing market can be unpredictable, especially in our growing town of Fuquay-Varina, with prices fluctuating and inventory levels changing. A local agent stays up-to-date on local market trends, helping you make informed decisions.

7. Your Personal Cheerleader 📣

Buying a home can be stressful, but a good local agent will be your cheerleader throughout the process. They’ll answer your questions, offer support, and celebrate your successes. At Front Porch Realty, our agents ensure a smooth process, keeping you informed every step of the way.

In conclusion, hiring a Fuquay-Varina local real estate agent is an investment in your peace of mind. They’ll guide you through the complexities of the home-buying process, ensuring a smooth and enjoyable experience. So, the next time you’re ready to buy a home, remember: a local agent is your key to unlocking your dream home.

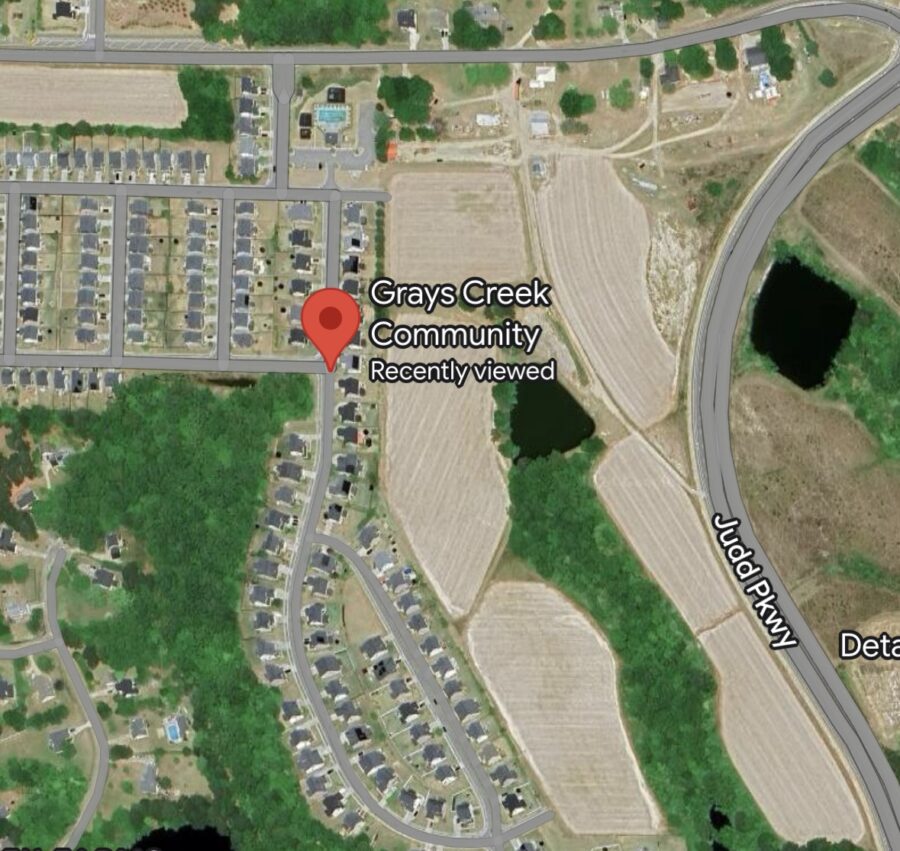

Gray’s Creek is a charming and family-friendly neighborhood nestled within the vibrant town of Fuquay-Varina. This community offers residents a peaceful and idyllic lifestyle, combining the tranquility of Southern living with the convenience of modern amenities.

Highlights of Gray’s Creek:

Price Range:

The price range for homes in Gray’s Creek is competitive, making it an attractive option for both first-time homebuyers and families looking to upgrade. Homes typically range from the mid-$300s to the low-$600s, depending on size, features, and lot size.

Living in Gray’s Creek:

Residents of Gray’s Creek appreciate the sense of community and the friendly atmosphere that prevails. The neighborhood is ideal for those seeking a peaceful and safe environment to raise a family or simply enjoy a relaxed lifestyle. With its beautiful homes, convenient amenities, and affordable pricing, Gray’s Creek is a wonderful choice for those looking to call Fuquay-Varina home.

Contact your LOCAL, INDEPENDENTLY OWNED, Fuquay-Varina Real Estate experts at Front Porch Realty to learn more about availible homes in Gray’s Creek.

The real question is why would you NOT want to sign a contract with a real estate professional? Truth is, your agent will be working on your behalf for one of the largest money decisions of your life! North Carolina has had Buyer Representation through Buyer Agency for years. Traditionally, the Buyer’s Agent has been paid by the seller of the home you are purchasing, i.e. reflected in the list price of the home. With a recent National Association of Realtors® nationwide lawsuit, NC real estate professionals must review what Buyer Agency is, and how they will get paid for this Agency, with every potential homebuyer BEFORE showing them a home, in person or virtually.

I am Laura Evans, the owner and Broker-in-Charge of Fuquay-Varina’s Independent real estate firm; Front Porch Realty. I have been selling our local real estate since 1996 and have gained insight over the years, seen the ups and downs, and so much more! Here are my thoughts on the recent National Assocition of Realtors® lawsuit and settlement…I have said it will be “Business As Usual” for Front Porch Realty and I am still declaring this, here is why –

At first glance, this may be a more “fair” way for agents to get paid for their services (the actual buyer they are representing pays them) however, forthcoming I see lots of unfortunate possibilities for buyers, as well as home sellers.

To me, this ruling is an unfortunate step backwards in the world of buying and selling homes. Commissions have ALWAYS been negotiable, and will continue to be. Front Porch Realty agents hold themselves to the business ethics standard proclaimed by the National Association of Realtors® and we will continue to do so.

The second big rule change stemming from the NAR lawsuit is that Buyer Agents MUST enter into a written Buyer Agency Agreement with their buyer CLIENT prior to showing them a home. This is another “Business As Usual” practice for Front Porch Realty. We KNOW there are lots of agents out there that will show prospective buyers homes at the drop of a hat, whether qualified or not, this has never been our practice at Front Porch Realty. As a seller, do you really want a non-qualified buyer touring your home? We have practiced teaching and educating our buyers on what to do when entering the housing market to position themselves into the best possible scenario to buy a home. The key term here is CLIENT. Of course buyers will still be able to find an agent that will jump for them anytime, day or night, to show them a home in hopes they can “make the sale”. Rest assured, Front Porch Realty agents put a lot of time, effort, and professionalism into helping our buyer client’s find a home and get them through offer to close.

Let us know how we can help you in your next real estate adventure!

-Laura Evans

Click HERE to get in contact with Front Porch Realty TODAY!

In the bustling world of real estate, the decision to sell your home is a significant one. It’s not just about listing a property; it’s about navigating a complex transaction that holds loads of emotional and financial weight. In such pivotal moments, the expertise and dedication of a local real estate agent can make all the difference.

At Independently Owned and Operated Front Porch Realty, we understand the unique charm and enticement of the Fuquay-Varina community. Our roots run deep here, and our commitment to serving our neighbors is unwavering. Here’s why choosing a local real estate agent like us is paramount:

When it comes to selling your home in Fuquay-Varina, don’t settle for anything less than the best. Don’t trust your most valuable asset to just anyone—trust the local experts who know, care, and are truly invested in your success.