Buying a home can be a thrilling adventure, but it can also be a minefield of paperwork, negotiations, and local quirks. That’s where a local real estate agent comes in – your trusty guide to navigating the housing market. Let’s explore why hiring a local agent is a smart move:

1. Local Knowledge, Local Love 💚

A local agent knows the area inside and out. They’re familiar with the best neighborhoods, schools, and hidden gems. They can tell you about the local coffee shops, the best hiking trails, and the annual town festivals. This insider knowledge can help you find a home that truly fits your lifestyle and Front Porch Realty has you covered on all things Local & Fuquay-Varina!

2. Spotting Hidden Potential 🔎

A seasoned local agent has a keen eye for a home’s potential. They can see beyond peeling paint and outdated fixtures. They might recognize a diamond in the rough – a fixer-upper with great bones and endless possibilities. Front Porch Realty agents take the time to listen and understand your main goals when it comes to searching for the perfect home. Whether you have accessibility needs, more rooms, a fenced-in back yard, or a better commute to your work, our agents will always keep your interests first.

3. The Art of Negotiation 🤝

Negotiating a home purchase can be a delicate dance. A skilled local agent knows how to negotiate effectively, without compromising your interests. They’ll leverage their knowledge of the market to get you the best possible deal.

4. Navigating the Paperwork Jungle 📃

Buying a home involves a mountain of paperwork. From loan applications to closing documents, it can be overwhelming. A local agent can guide you through the process, ensuring everything is in order and on time.

5. Local Connections, Local Perks 👍

A local agent often has connections with other professionals in the area, such as mortgage brokers, inspectors, and contractors. These connections can save you time and money, especially when dealing with local regulations and permits.

6. Understanding Fuquay Market Trends 📈

The housing market can be unpredictable, especially in our growing town of Fuquay-Varina, with prices fluctuating and inventory levels changing. A local agent stays up-to-date on local market trends, helping you make informed decisions.

7. Your Personal Cheerleader 📣

Buying a home can be stressful, but a good local agent will be your cheerleader throughout the process. They’ll answer your questions, offer support, and celebrate your successes. At Front Porch Realty, our agents ensure a smooth process, keeping you informed every step of the way.

In conclusion, hiring a Fuquay-Varina local real estate agent is an investment in your peace of mind. They’ll guide you through the complexities of the home-buying process, ensuring a smooth and enjoyable experience. So, the next time you’re ready to buy a home, remember: a local agent is your key to unlocking your dream home.

A New Dawn in Fuquay-Varina

As a newer addition in Fuquay-Varina’s crown, Sunset Bluffs offers a tranquil retreat for families and individuals alike. This picturesque neighborhood is nestled in a prime location, providing easy access to the vibrant city of Raleigh while maintaining a peaceful, small-town atmosphere.

A Community of Comfort and Convenience

Sunset Bluffs is more than just a collection of homes; it’s a community designed to enhance your lifestyle. Here, you’ll find a host of amenities to cater to your every need:

A Range of Homes to Suit Every Taste

Whether you’re a first-time homebuyer or a seasoned investor, Sunset Bluffs offers a diverse selection of homes to fit your lifestyle and budget. From cozy starter homes to spacious family residences, you’ll find a variety of floor plans and architectural styles.

Price Range:

Homes in Sunset Bluffs typically range from the mid $400,000s to over $1 million, making it an attractive option for those seeking a balance of affordability and luxury.

Why Choose Sunset Bluffs?

If you’re looking for a place to call home where you can unwind, recharge, and connect with your community, Sunset Bluffs is the perfect choice.

Contact your LOCAL, INDEPENDENTLY OWNED, Fuquay-Varina Real Estate experts at Front Porch Realty to learn more about available homes in Sunset Bluffs.

Discover Your Dream Home in Purfoy Place

Nestled just southeast of the bustling Triangle region, Purfoy Place offers a tranquil escape without sacrificing convenience. Situated a mere four miles from Fuquay-Varina’s Downtown area, this charming neighborhood provides easy access to the best of both worlds: serene country living and urban amenities.

A Picture-Perfect Setting

Rolling pastures, serene ponds, and a peaceful cul-de-sac create the ideal backdrop for your dream home. Each spacious homesite, spanning nearly half an acre, offers plenty of room for outdoor activities and personal touches. Modern conveniences like curb and gutter and sidewalks on the north side of the street enhance the neighborhood’s appeal.

Custom Homes, Timeless Elegance

Purfoy Place is proud to partner with renowned local builders: Kara Homes, Glover Design Build, and Gemstone Homes. These experienced craftsmen are dedicated to creating stunning custom homes that blend classic architecture with contemporary design. With a starting price in the low $500s, you can own a beautiful, high-quality home that fits your budget and lifestyle.

A Thriving Community

While Purfoy Place offers a peaceful retreat, it’s also part of a vibrant community. Residents enjoy easy access to nearby schools, shopping centers, and dining options. The low HOA fee of $360 per year covers essential maintenance and community upkeep, ensuring a well-maintained and welcoming environment.

Your Local Real Estate Experts

Front Porch Realty is your trusted partner in finding your dream home in Purfoy Place. Our knowledgeable agents are intimately familiar with the neighborhood and can help you navigate the home-buying process with ease. From selecting the perfect homesite to helping you find your dream home, we’re here to guide you every step of the way.

Contact your LOCAL, INDEPENDENTLY OWNED, Fuquay-Varina Real Estate experts at Front Porch Realty to learn more about available homes in Purfoy Place. There are currently TWO beautiful listings for you to check out!

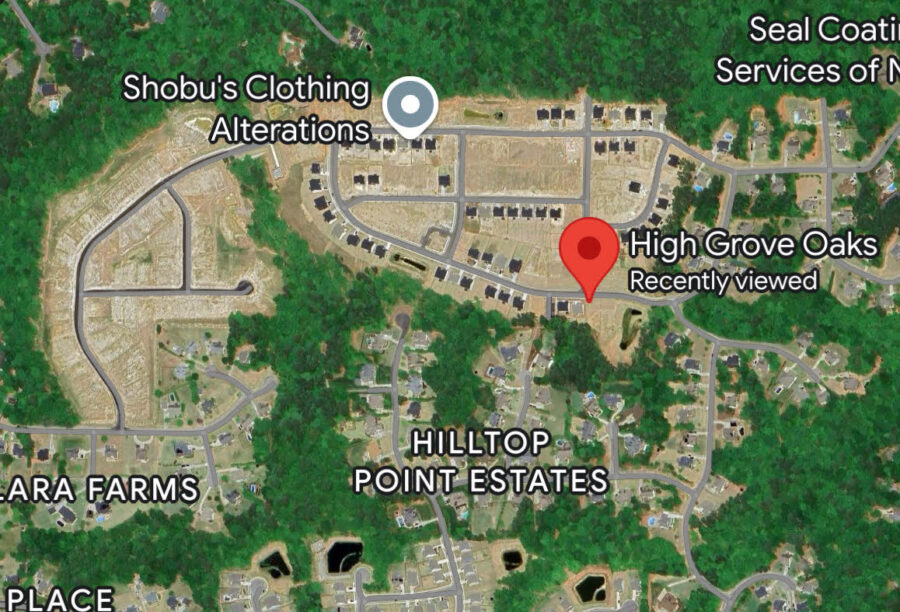

High Grove Oaks is a picturesque neighborhood nestled in the heart of Fuquay-Varina. Developed by the renowned Mattamy Homes, this community offers a serene and family-friendly atmosphere.

Key Highlights of High Grove Oaks:

Living at High Grove Oaks

High Grove Oaks offers a welcoming and family-friendly environment. Residents can enjoy the benefits of living in a well-maintained community with access to top-notch amenities. The neighborhood’s proximity to schools, shopping, and recreational facilities makes it an ideal choice for families and individuals seeking a comfortable and convenient lifestyle.

Contact your LOCAL, INDEPENDENTLY OWNED, Fuquay-Varina Real Estate experts at Front Porch Realty to learn more about availible homes in High Grove Oaks.

The real question is why would you NOT want to sign a contract with a real estate professional? Truth is, your agent will be working on your behalf for one of the largest money decisions of your life! North Carolina has had Buyer Representation through Buyer Agency for years. Traditionally, the Buyer’s Agent has been paid by the seller of the home you are purchasing, i.e. reflected in the list price of the home. With a recent National Association of Realtors® nationwide lawsuit, NC real estate professionals must review what Buyer Agency is, and how they will get paid for this Agency, with every potential homebuyer BEFORE showing them a home, in person or virtually.